Have you noticed that your student loan burden is challenging you? You’re not alone. Millions of Americans are troubled by student loan debt and wonder if they will ever be able to get relief.

Luckily, there are ways to ease the burden of student loan debt through choices for forgiveness. We’ll explore the many ways to student loan forgiveness in this post, giving you the information you need to make the right financial decisions coming the future.

22 December · Season 1 : Student Loans · Episode 2

Discover The Options for Student Loan Forgiveness Programs

By Krishna Sahani

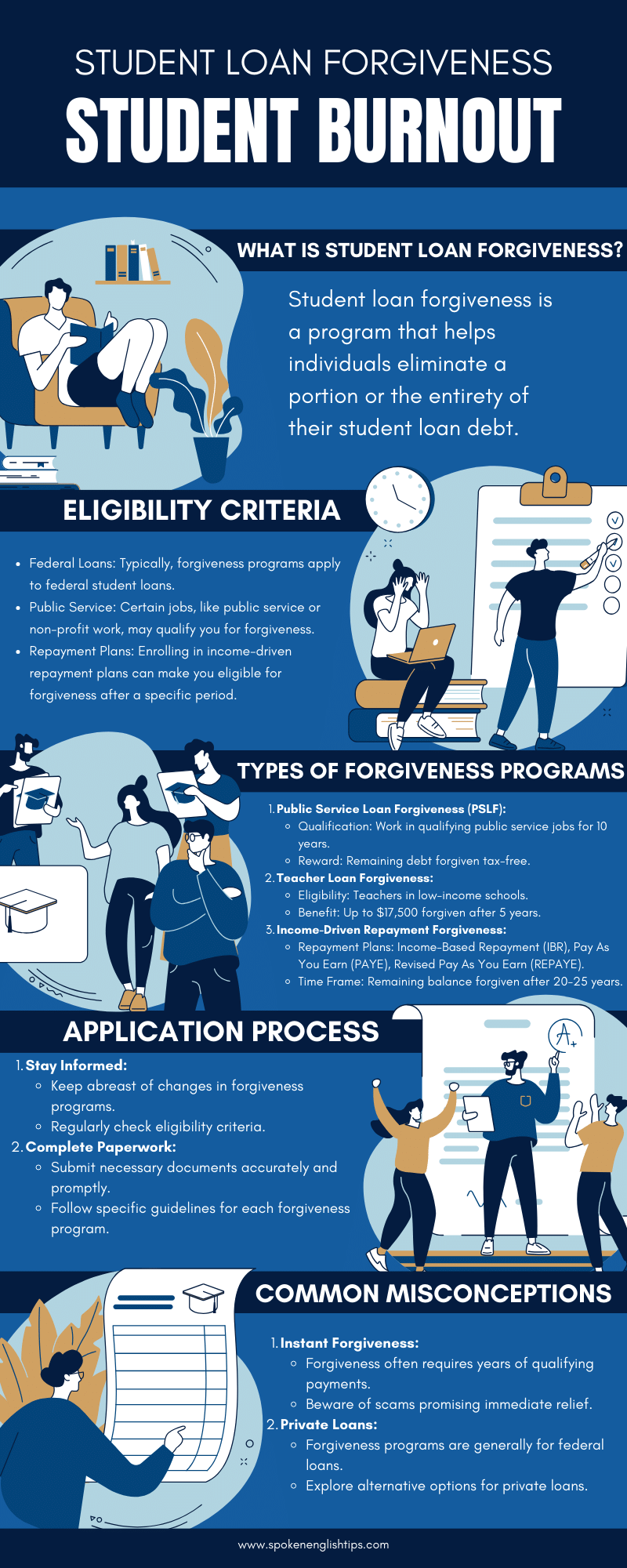

1. Public Service Loan Forgiveness (PSLF)

Does a government or nonprofit organization employ you? If so, you may qualify for Public Service Loan Forgiveness (PSLF).

This program enables eligible borrowers to have their remaining student loan balances forgiven after making 120 qualifying monthly payments while working full-time for a qualifying employer. Here are some key points to keep in mind:

– Eligibility requirements:

To qualify, you must have direct loans and be enrolled in an income-driven repayment plan. Your job must also meet the program’s criteria for public service employment.

– Potential benefits:

PSLF offers significant benefits, such as tax-free forgiveness and the potential for complete loan forgiveness after 10 years of qualifying payments.

– Important considerations:

Ensure you are familiar with the program requirements and carefully track your progress. Additionally, periodically check for updates and verify your eligibility with the official PSLF website.

“PSLF offers borrowers in public service jobs an opportunity to achieve both their career goals and financial freedom.”

2. Income-Driven Repayment Plans

If qualifying for PSLF is not an option or you have private loans, income-driven repayment plans can provide relief by capping your monthly loan payments based on your income and family size.

After making payments for a set number of years (usually 20 or 25), any remaining loan balance may be forgiven. Here’s what you need to know:

– Types of income-driven repayment plans:

There are several income-driven repayment plans to choose from, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). Each plan has its eligibility requirements and calculations for repayment.

– Qualification factors:

Although earnings repayment plans can help simplify monthly payments, your eligibility will vary depending on several criteria, including the loan you have, when you took it out, and your income.

– Long-term considerations:

While revenue programmes can offer some relief, it’s important to realize that paying more interest over time may occur from extending the payback duration. Before committing to a revenue plan, consider your options.

“Income-driven repayment plans offer flexibility and affordability, allowing borrowers to tailor their repayment to their current financial situation.” – income-driven repayment plans.

3. Teacher Loan Forgiveness Program

Teachers play a crucial role in shaping our future, and as a token of appreciation, the government offers the Teacher Loan Forgiveness Program. This program provides eligible full-time teachers working in low-income schools with the opportunity to have a portion of their federal loans forgiven. Here’s what you should know:

– Eligibility requirements:

To qualify, you must be a highly qualified teacher with five consecutive years of teaching at a qualifying low-income school or educational service agency. Only certain loans, such as Stafford and Direct Subsidized/Unsubsidized Loans, may be eligible.

– Forgiveness amount:

Depending on the subject area taught and the number of years of full-time teaching, you may be eligible for up to $17,500 in loan forgiveness.

– Key factors to consider:

Understand the specific requirements and document your eligibility diligently. Some borrowers may benefit more from PSLF or income-driven repayment plans, so compare your options before committing to the Teacher Loan Forgiveness Program.

“The Teacher Loan Forgiveness Program recognizes the invaluable contributions teachers make to society, supporting them in their mission to educate and inspire future generations.” –

Conclusion:

Navigating the maze of student loan forgiveness options can feel overwhelming, but there is hope for those burdened by student loan debt.

Whether you qualify for Public Service Loan Forgiveness, income-driven repayment plans, or the Teacher Loan Forgiveness Program, taking action can help you regain control of your financial future.

Explore the resources provided, reach out to relevant authorities, and take steps toward a brighter, debt-free tomorrow.

Remember, everyone’s financial situation is unique. Consider consulting a financial advisor or student loan expert to determine the best course of action for you.

The key is to take that first step towards finding student loan relief, forging your path toward a brighter financial future.