Usually, private student loans have lower interest rates compared to personal loans. Plus, they give you the option to pick between a fixed or variable interest rate.

Hay, are you looking for the perfect answer to ‘What is one benefit of privately issued student loans?’ then here you will get the complete guide in detail.

What is One Benefit of Privately Issued Student Loans?

Because the government doesn’t promise to pay back these loans, you might have more choices for how you pay them back.

The government doesn’t promise to pay back these loans, so you have more choices in how you give the money back.

You can spend this money on anything, not just school fees.

Normally, the interest rates on private loans are lower than the ones on government student loans.

You can use them to cover the cost of your classes, the place to stay, and other things you need for college.

You can take out a private student loan to get money for your college costs, like tuition and other things you need for school. You can also use the loan to pay for books, transportation, and living expenses.

They offer fixed rates, which are lower than federal loans.

Usually, fixed interest rates are lower than variable rates. This applies to different kinds of loans, like student loans.

Federal student loans, for instance, have variable rates that can change, but the typical rate for new borrowers was 7 percent for the 2019-20 school year.

Subsidized Stafford Loans, which are for students with low incomes, had an average rate of 5.5 percent.

Private lenders provide fixed rates ranging from 5 to 12 percent, along with fees. According to Bankrate data collected by LendingTree in April 2019, credit card debt typically has an APR of 15%, while auto loans have an average APR of 4%.

Private student loans are safer than some other debts, such as credit cards. Because of this, they usually have lower interest rates compared to both federal and private student loans.

The rates are often lower than what you would pay if you used cash advances or credit lines from your bank account or credit cards.

Student loans that come from private sources give you more choices on how you can pay back the money.

One good thing about getting student loans from private companies is that you can take your time paying them back.

Government loans usually make you pay back what you owe in 10, 15, or 20 years. But with private lenders, you can choose to pay back the money in 5 to 30 years.

This lets you have more control over how much you pay each month and gives you more freedom in your job choices.

Just like government loans, private lenders also have flexible payment plans. They offer options like graduated payment plans, where you start by paying less and then slowly pay more over time.

This helps you make progress on your total debt while giving you a bit of breathing room, especially if you’re not earning a full-time salary yet.

It lets you start repaying your debt sooner, but it also allows you to delay payments if you need to—or maybe even get rid of some of your debt!

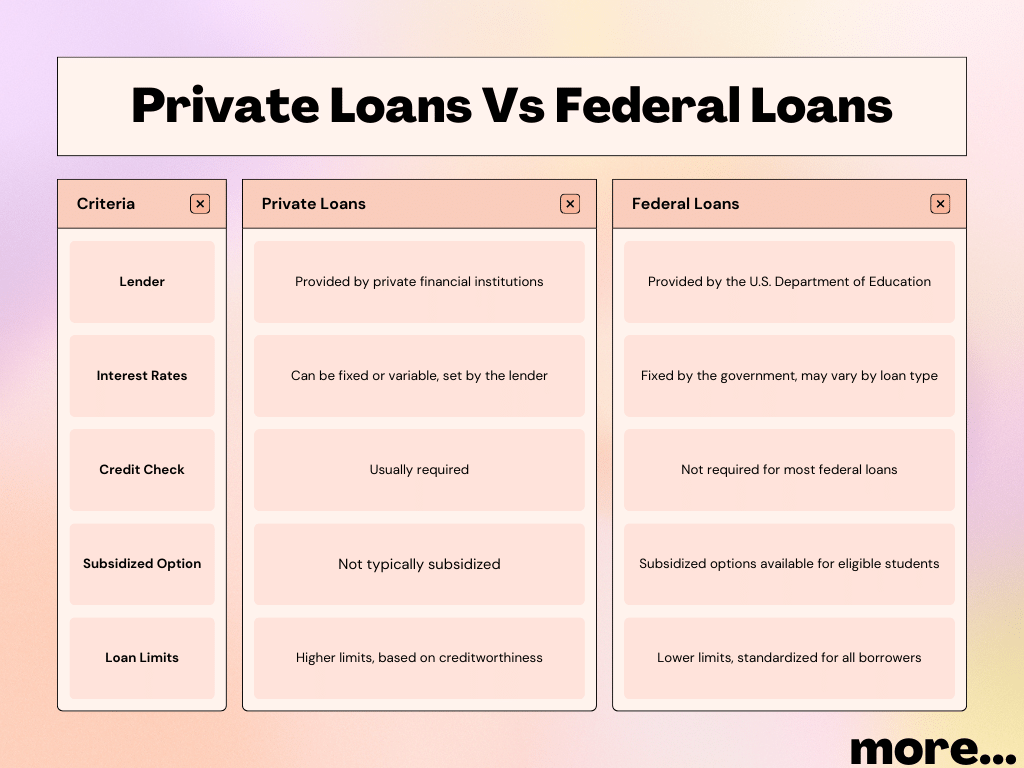

Private Vs Federal Loans

| Criteria | Private Loans | Federal Loans |

|---|---|---|

| Lender | Provided by private financial institutions | Provided by the U.S. Department of Education |

| Interest Rates | Can be fixed or variable, set by the lender | Fixed by the government, may vary by loan type |

| Credit Check | Usually required | Not required for most federal loans |

| Subsidized Option | Not typically subsidized | Subsidized options available for eligible students |

| Loan Limits | Higher limits, based on creditworthiness | Lower limits, standardized for all borrowers |

| Repayment Terms | Varies by lender | Standardized and flexible repayment plans |

| Grace Period | Determined by the lender | Standard grace period for most federal loans |

| Loan Forgiveness | Rarely offers forgiveness programs | Various forgiveness programs available for certain federal loans |

| Consolidation | Private consolidation options available | Federal consolidation available with specific terms |

| Deferment Options | Varies by lender | Standard deferment options for federal loans |

| Cosigner | Often requires a cosigner | Not required, but available for better terms |

| Application Process | Typically more complex | Standardized application process for federal loans |

| Accessibility | Depends on credit history and eligibility | Widely accessible to eligible students |

Final Thought

We hope we’ve made it clear why getting private student loans could be good for you. If you’ve got any questions, just reach out to us!