Monthly Payment: $

What is a loan?

A loan is a sum of money that is borrowed from a lender, such as a bank or financial institution, with the expectation that it will be repaid with interest. The borrower may use the loan for a variety of purposes, such as to purchase a home, or a car, or to cover unexpected expenses. In exchange for the loan, the borrower typically agrees to pay back the principal, which is the original amount borrowed, plus interest, which is a fee charged by the lender for the use of their money.

There are several different types of loans, such as secured loans, which are backed by collateral, and unsecured loans, which are not. There are also different terms and conditions for different types of loans, such as short-term loans, which are typically paid back within a year, and long-term loans, which may have repayment terms of several years.

When applying for a loan, the borrower is typically required to provide information about their income, assets, and credit history, and the lender will use this information to assess the borrower’s ability to repay the loan.

In brief, A loan is a financial arrangement in which a lender provides a borrower with a certain amount of money, and the borrower agrees to repay the loan with interest over a specific period of time.

What is Car Loan Calculator?

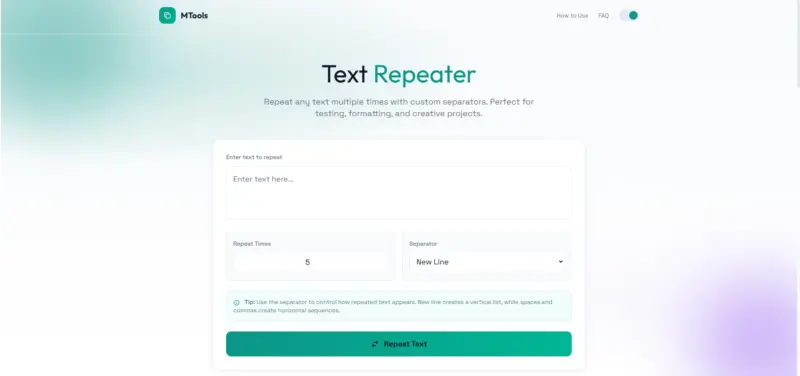

A car loan calculator is a tool that is used to calculate the monthly payment for a car loan. It typically takes into account the principal (the amount being borrowed), the interest rate, and the loan term (in years) and uses that information to estimate the monthly payment required to repay the loan.

The car loan calculator typically provides an interface for users to enter the principal, interest rate, and loan term, and then displays the estimated monthly payment. Some car loan calculators may also be able to estimate the total interest, the total payments, and other information.

Car loan calculators typically use a basic mathematical formula called the amortization formula. which is used to calculate the payment schedule of the loan, and to calculate how much of each payment goes to interest, and how much goes to reducing the principal balance of the loan.

Car loan calculators can be found on many websites, including bank and car dealership websites. They can also be found as mobile apps. Users can use them to get an idea of what kind of monthly payments they can expect and to help compare different loan options.

How to pay off car loan faster calculator?

There are several ways to pay off a car loan faster, and a car loan calculator can help you estimate the impact of different strategies on the total cost of the loan and the length of the loan. Here are a few common strategies to pay off a car loan faster:

- Make extra payments: If you have extra money available, consider making additional payments on top of your regular monthly payments. This will help you pay down the principal faster, and can significantly reduce the length of the loan.

- Refinance: Refinancing your car loan can lower your interest rate, which can result in lower monthly payments and help you pay off the loan faster. Keep in mind that you should consider the cost of refinancing such as the application fee, and the total cost of the loan after refinancing to make sure it makes sense.

- Round up payments: Instead of paying the exact amount of your monthly payment, consider rounding up your payments to the nearest whole dollar. This extra amount will go toward paying down the principal.

- Bi-weekly payments: Instead of paying your car loan once a month, consider making bi-weekly payments. This will result in one additional payment per year, which can shorten the loan term.

- You can use a car loan calculator to compare the different scenarios of paying off the loan, and it will give you an idea of the impact of each strategy on the total cost of the loan and the length of the loan.

It’s important to note that each individual scenario is different, there are some car loans that may have a pre-payment penalty, so make sure to check that before deciding to pay the loan off faster. Also, the interest rate and the loan term are usually fixed, so, you should make sure that the savings you’ll make by paying off the loan faster will outweigh the cost of any penalties, and any potential fees.

How much interest car loan calculator?

There are many online car loan calculators that can help you determine how much interest you will pay on a car loan. These calculators typically ask for the following information:

- The purchase price of the car

- The down payment or trade-in value

- The length of the loan (in years)

- The annual interest rate (APR)

Once you enter this information, the calculator will give you an estimated monthly car payment and an estimate of the total interest you will pay over the life of the loan.

Here’s an example of how the calculations work: Let’s say you’re buying a car for $20,000, you’re putting $2,000 down, and you’re financing the remaining $18,000 over 5 years at an APR of 4%. The calculator would estimate that your monthly car payment would be $334.65, and the total interest you would pay over the 5 years of the loan would be $1,727.58

Keep in mind that the interest rate offered to you may vary depending on your credit score and credit history, so be sure to shop around for the best interest rate you can get.

You can also use different online calculator to check the affordability of car loan, you can use that to compare different interest rate, the car amount and down payment, so you can decide which option fit your budget.