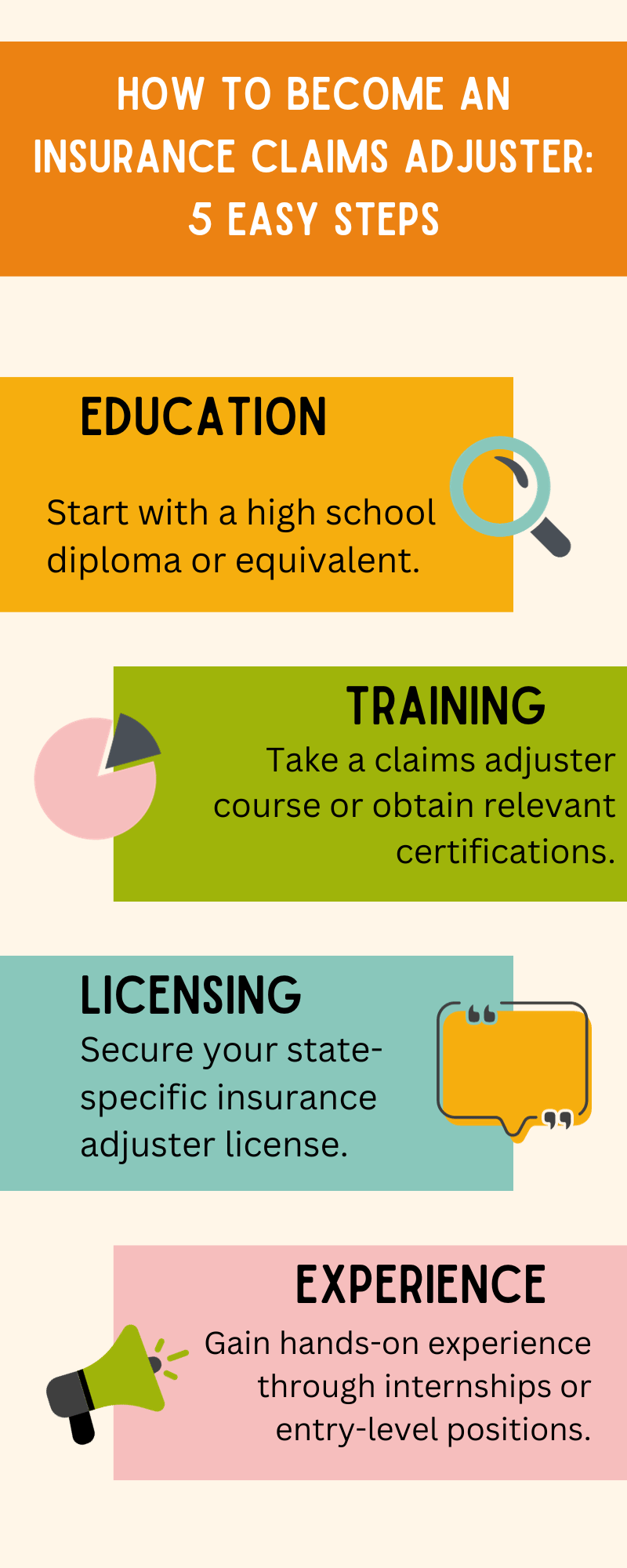

Today I gonna explain in just five steps How to Become an Insurance Claims Adjuster.

This article is your ultimate guide on how to become an insurance claims adjuster. We’ll walk you through the entire process, highlighting the simplicity, cost-effectiveness, and flexibility of online learning, making it accessible to anyone interested in this rewarding career. Whether you’re seeking a stable profession or a lucrative part-time gig, this guide has you covered.

Embarking on the journey to become an insurance claims adjuster is elegantly uncomplicated, particularly when juxtaposed with the arduous commitment of pursuing a traditional college or technical degree. The best part? You have the autonomy to fulfill most prerequisites at your convenience, all through the accessible realm of online learning.

Moreover, the allure of a newfound, exhilarating career as a claims adjuster beckons within just a few short weeks. In the following discourse, we shall intricately explore the quintessential five steps:

- Aligning Aspirations Determine if insurance adjusting aligns with your goals.

- Choosing Your Path Select the right adjuster role for your ambitions.

- License Milestone Secure your adjuster license, a career cornerstone.

- Boosting Proficiency Enhance your skills for success in adjusting.

- Job Journey Navigate job applications and opportunities.

As we delve into these steps, the path to a fulfilling career as an insurance claims adjuster unfolds before you, resplendent in its simplicity.

Step 1: Determine if Claims Adjusting is Right for You

Skills and Qualities Required:

Becoming a successful claims adjuster requires a mix of hard and soft skills. While the hard skills are straightforward (e.g., being at least 18 years old, holding a valid driver’s license, and residing in your state), it’s the soft qualities that set great adjusters apart. These include self-discipline, a strong work ethic, and excellent communication skills.

Challenges and Rewards:

Claims adjusting is a challenging yet incredibly rewarding profession. The financial rewards are substantial, and the emotional satisfaction of helping people rebuild their lives after a loss is deeply fulfilling. The potential for annual earnings exceeding $100,000 for independent adjusters and salaries ranging from $45,000 to $80,000 or more for staff adjusters makes it a lucrative career choice.

Demand in All Economic Conditions:

The demand for insurance adjusters remains consistent regardless of economic fluctuations. Claims need to be processed, whether the economy is thriving or facing challenges. During catastrophes, such as after natural disasters like Hurricane Harvey or Irma, the need for adjusters skyrockets, presenting a substantial income-boosting opportunity.

Bright Future of the Industry:

The insurance adjusting industry is evolving rapidly, with a wave of retirements creating a need for fresh talent. As more experienced adjusters retire, the industry seeks new professionals to fill this void. This changing landscape provides aspiring adjusters with a promising future and ample job opportunities.

Step 2: Choose Your Adjuster Path

When embarking on your journey to become an insurance claims adjuster, it’s crucial to understand the various career paths available. Each path comes with its unique set of responsibilities and opportunities for specialization. Here, we’ll explore the options and delve into the roles and responsibilities associated with each:

1. Staff Adjusters:

- Role: Staff adjusters are typically full-time employees of an insurance company. They work year-round and handle claims on behalf of their employer.

- Responsibilities: Staff adjusters investigate and evaluate claims made by policyholders. They assess the extent of damage or loss, estimate the cost of repairs, and negotiate settlements.

- Specialization: Within the staff adjuster role, specialization can occur based on the type of insurance (e.g., property, auto, liability), the complexity of claims, or the specific needs of the employing insurance company.

2. Independent Insurance Adjusters:

- Role: Independent adjusters operate as contractors who provide their services to multiple insurance companies. They are not bound to a single employer and handle claims on a case-by-case basis.

- Responsibilities: Independent adjusters investigate and assess claims, similar to staff adjusters. However, they have the flexibility to work with various insurance carriers, often handling multiple claims simultaneously.

- Specialization: Independent adjusters can specialize in a particular niche, such as catastrophe claims, auto insurance, workers’ compensation, or marine claims. Their versatility allows them to explore diverse areas of the industry.

3. Catastrophe Adjusters:

- Role: Catastrophe adjusters can be either staff or independent adjusters. They are deployed to areas struck by natural disasters or large-scale events, such as hurricanes, earthquakes, or wildfires, to handle a surge in claims.

- Responsibilities: Catastrophe adjusters assess the extensive damage resulting from catastrophic events, often working in high-stress and challenging conditions. They help policyholders recover quickly and efficiently during these crises.

- Specialization: Catastrophe adjusters are specialists in handling large-scale disasters, which is a unique niche in the field. They might also develop expertise in particular types of catastrophes, depending on their experience and preferences.

4. Inside or Desk Adjusters:

- Role: Inside or desk adjusters handle claims primarily from an office or call center. They may collaborate with field adjusters or contractors who perform inspections and provide data to estimate and settle claims.

- Responsibilities: Inside adjusters review the information provided by field agents, policyholders, and any involved parties to determine the claim’s validity and assess damages. They then negotiate settlements and process paperwork.

- Specialization: Inside adjusters often specialize in handling claims remotely, relying on documentation and data analysis. They may also focus on specific types of insurance, such as property or liability.

Step 3: Get Your Insurance Adjuster License

Discuss the Importance of Licensing Becoming a licensed insurance claims adjuster is a critical step in launching your career in this field. Here’s why licensing matters:

- Legal Requirement: In most states, it’s a legal requirement to hold an adjuster license to work in this industry. Only a few states, like Colorado, Kansas, and Wisconsin, don’t require adjuster licenses.

- Client Expectations: Many insurance companies, especially the larger ones, expect adjusters to be licensed. They prefer working with professionals who meet this standard.

- Industry Credibility: Licensing demonstrates your commitment to professionalism and competence, which can boost your credibility and earning potential.

- Mobility: If you’re licensed in your home state, you can also apply for reciprocal licenses in other states where you plan to work, which simplifies working across state lines.

Provide Information on AdjusterPro’s Training AdjusterPro offers comprehensive training to help you obtain your adjuster license with confidence. Our training includes:

- State-Specific Courses: We provide courses tailored to the licensing requirements of different states. These courses are designed to prepare you for the state’s licensing exam, covering relevant materials and ensuring you’re well-prepared.

- Exemptions: In some cases, we can even help you secure an exemption from taking the state’s licensing exam, making the process smoother and faster.

- Designated Home State (DHS) License: If your state doesn’t license insurance adjusters, you can obtain a DHS license from Florida. Our Florida Certified Adjuster Course fulfills all the requirements for obtaining this important license.

- Reciprocal Licensing Assistance: Once you secure your initial license, we can guide you through the process of applying for reciprocal licenses in other states. This can expand your opportunities and client base.

Explain Licensing Requirements in Different States Licensing requirements can vary from one state to another, so it’s essential to understand the specific criteria for your state. While most states have similar baseline requirements, some may have additional conditions such as pre-licensing education or fingerprinting.

- We recommend visiting our Adjuster Licensing Courses page to find information on the type of course needed for your state.

- For states that don’t license insurance adjusters but require you to be licensed to work claims elsewhere, consider obtaining a DHS license, such as the one from Florida. This often fulfills the licensing requirements for most states.

- Each state’s application process and requirements may differ, so we include step-by-step instructions in our courses to help you navigate the application process with ease.

Mention the Importance of a Designated Home State (DHS) License and Reciprocal Licenses A Designated Home State (DHS) license, typically obtained from a state like Florida, holds significant importance in the adjuster profession:

- While you might not need a license to work in your home state, having a DHS license is vital for working claims in other states.

- Many independent adjusting firms require adjusters to hold a license, even if they don’t reside or work in a licensing state.

- Securing a DHS license can open doors to a wider range of job opportunities, especially if you plan to work in states that frequently experience catastrophic events.

- Additionally, once you have your adjuster license, applying for reciprocal licenses in other states where you want to work is essential to broaden your reach and client base. Most states offer reciprocal licenses without requiring an additional exam.

Step 4: Learn Essential Skills

1. Xactimate Training

- Why Xactimate? Explain the importance of Xactimate training as the industry-standard claims writing software.

- Essential Skill: Emphasize that proficiency in Xactimate is critical for success in the claims adjusting field.

- Course Recommendation: Mention the Tactical Xactimate Training course and its comprehensive coverage.

- Success Assurance: Highlight that becoming proficient in Xactimate is key to effectively closing claims.

2. Carrier Certifications

- Why Carrier Certifications? Discuss the value of obtaining certifications from insurance carriers.

- State Farm Certification: Explain why obtaining a State Farm Certification is a worthwhile goal.

- Importance of Additional Training: Mention that additional training may be recommended by employers after being hired.

3. Introducing the Adjuster Success Method

- What is the Adjuster Success Method? Provide an overview of this unique training course.

- Launch Your Career: Explain that this course helps newly licensed adjusters develop a systematic approach to launching their claims-adjusting career.

- Veteran Insights: Mention that the course features insights and best practices from experienced adjusters.

- Proven Success: Highlight that this course can help new adjusters successfully close their first claims.

Step 5: Land Your First Adjusting Job

Landing your first job as an insurance claims adjuster can be a rewarding experience. Here are some strategies and tips for job seekers, whether you’re aiming to work as a staff adjuster or an independent adjuster:

1. Job Search Strategies

- Staff Adjusters: If you’re pursuing a staff adjuster position, start by reaching out to HR departments at insurance companies. Inquire about job openings and their hiring process. Many insurance carriers post job listings on their websites, so regularly check for job postings.

- Independent Adjusters: For independent adjusters, consider contacting Independent Adjusting (IA) firms. These firms often work with multiple insurance companies and regularly require adjusters. Connect with their HR departments or check their websites for job listings.

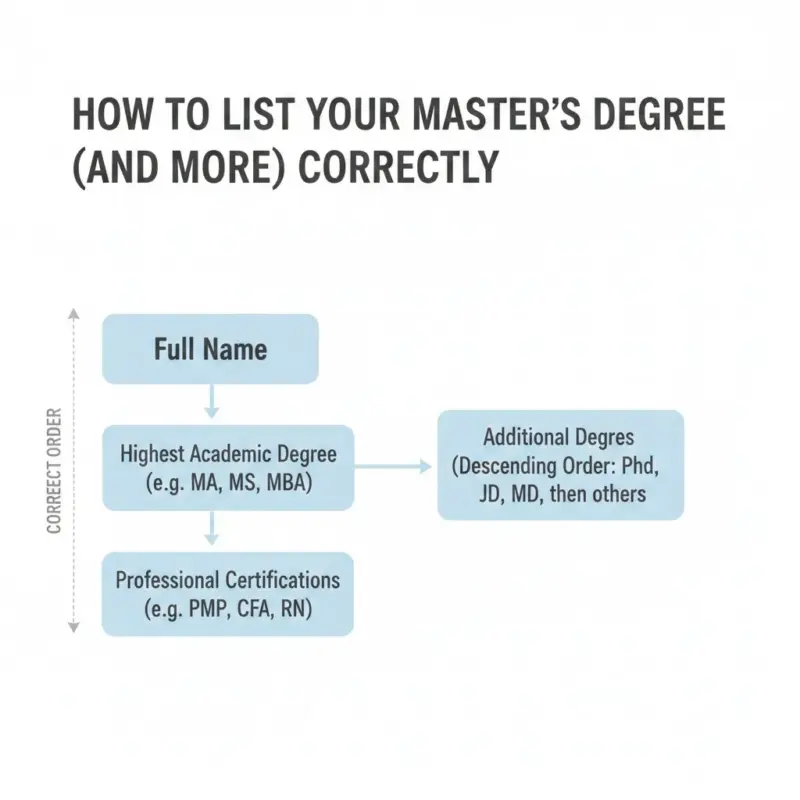

2. Tailored Resumes

- Craft a resume specifically tailored to the claims industry. Highlight relevant skills, qualifications, and training, including your adjuster license and any certifications. Show that you understand what employers look for in a claims adjuster. Be sure to emphasize your adaptability and willingness to travel if applicable.

3. Total Adjuster Package

- Consider enrolling in the Total Adjuster Package. This comprehensive bundle typically includes your licensing course, Xactimate training, and the Adjuster Success Method. This package can set you on the right path by providing the necessary skills and certifications that employers value.

4. Getting on Employers’ Rosters and Follow-Up

- To increase your chances of getting hired as an independent adjuster, aim to get on the rosters of the adjusting firms you’re interested in. Develop a strategic plan for reaching out to these firms. Keep in mind that smaller adjusting firms can also be valuable partners.

- After sending out applications and resumes, follow up diligently. A well-timed follow-up call or email can demonstrate your commitment to the job and keep you on the employer’s radar.

5. Networking and Staying Compliant

- Join local and national industry associations and participate in insurance job boards. Networking can lead to valuable connections and job opportunities.

- Stay compliant by keeping your licenses current and in good standing. Being prepared to deploy quickly, especially during catastrophe season, is crucial. Adjusters often have to respond on short notice, so always be ready to take advantage of opportunities when they arise.

Landing your first job as an insurance claims adjuster may take some time and persistence, but with the right approach, you can start your career successfully. Stay proactive, remain adaptable, and continually update your skills to maximize your chances of finding the perfect fit in the claims adjusting industry.