Not many private student loans are forgiven, but good lenders will help you avoid falling behind on payments.

If you owe a lot of money for your student loans, it might be hard to pay each month or get approval for other kinds of credit. This is often the case for people with private student loans who can’t use income-based repayment plans. Altogether, those with private student loans owe $128 billion, which is 7.3% of the total $1.76 trillion student loan market.

Getting rid of private student loan debt isn’t simple. But, you can do things to make it easier to pay or get help with payments from your state.

Can Private Student Loans be Forgiven?

Private student loans are hardly ever forgiven. Usually, forgiveness only occurs if the person who borrowed the money is unable to work anymore or passes away.

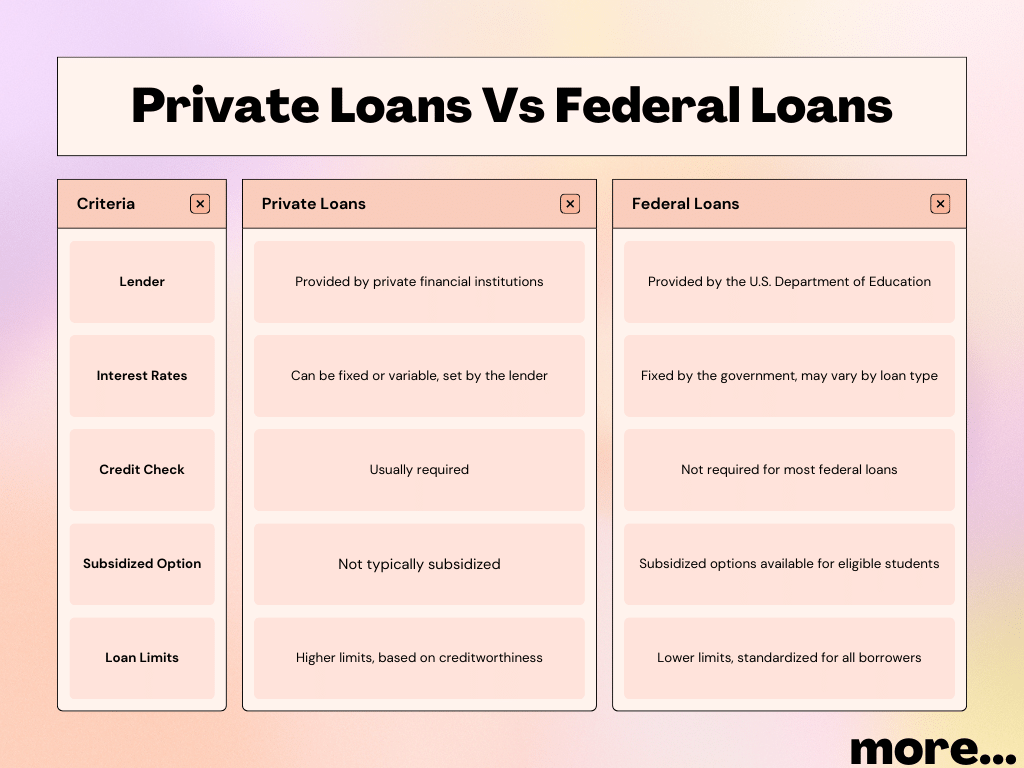

If you have a private student loan, you won’t get forgiveness even if you work in a public service job and make payments for a specific number of years. Only people with federal student loans can get these benefits.

If you borrowed money for school from a private source like a bank, you can’t get help from the plan President Joe Biden talked about in August 2022. Even if the Supreme Court agrees with the plan, it only applies to people who borrowed from the government for their education.

A person who knows a lot about student loans, Jay Fleischman, says, “The plan the Biden team suggested is only for loans from the government, not for private ones.” That’s because the government is in charge of loans from them. But when you borrow from a bank or credit union, those are private loans.

Fleischman explains, “People or companies giving out private student loans can decide if they want to forgive or cancel the debt, but they don’t have to do it by law.” So, it’s up to the lenders, like banks, to decide if they want to help you in that way.

What to Do if You Need Private Student Loan Forgiveness

- Contact Your Lender: Reach out to your private loan lender and inquire about any forgiveness or repayment assistance programs they might offer. While they aren’t obligated by law to provide forgiveness, some lenders may have options or policies in place.

- Explore Repayment Options: Check if your lender has alternative repayment plans that could make it easier for you to manage your loan. Some lenders offer income-driven repayment plans or extended repayment terms.

- Keep an Eye on Policy Changes: Stay informed about any changes in government policies or new programs that may affect private student loans. Although current forgiveness plans mainly focus on federal loans, policies could evolve over time.

- Seek Legal Advice: Consult with a student loan attorney to understand your rights and options. They can provide guidance on navigating the complexities of private student loans and advise you on potential courses of action.

- Financial Hardship Documentation: If you’re facing financial hardship, gather documentation to support your situation. Some lenders may be more willing to work with you if they see evidence of genuine need.

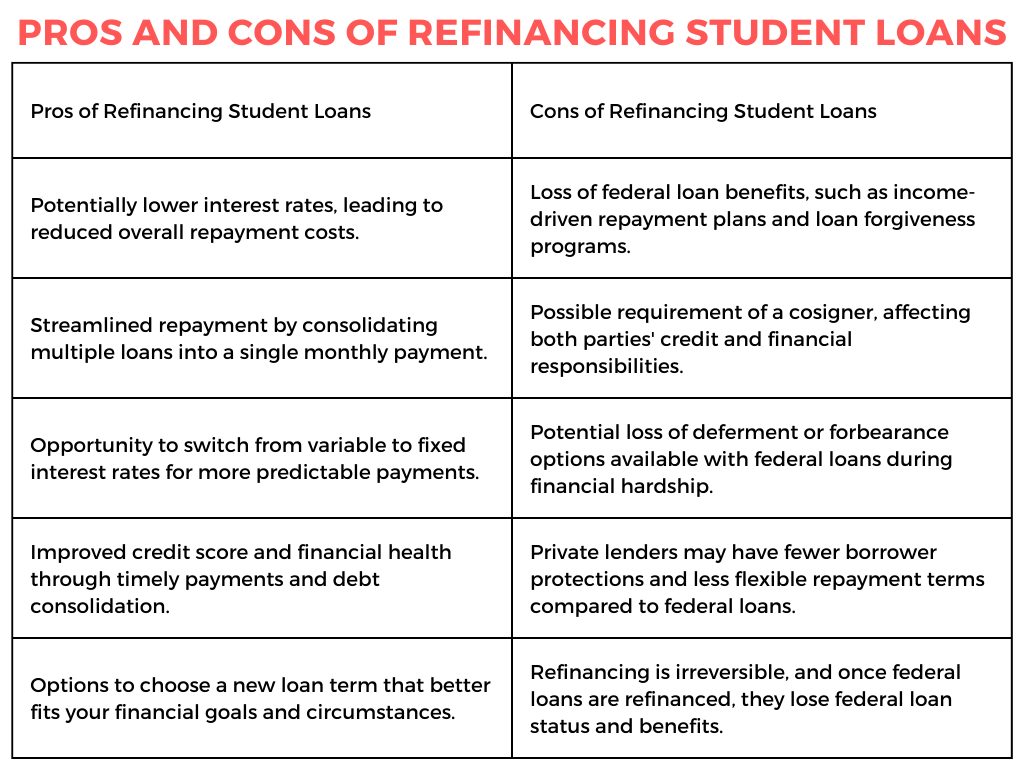

- Consider Refinancing: Explore the possibility of refinancing your private student loans. Refinancing involves taking out a new loan to pay off existing ones, potentially with more favorable terms. However, be cautious and carefully review the terms before deciding.

- Budget Wisely: Develop a realistic budget to manage your finances effectively. Prioritize loan payments within your budget to ensure timely payments and prevent additional financial stress.

Remember that private student loan forgiveness options are generally limited compared to federal loans. It’s crucial to proactively communicate with your lender, explore available alternatives, and stay informed about any changes in the landscape of student loan policies.