can I refinance my private student loans? Ideally, Refinancing is available for both federal and private student loans.

Yes, you can refinance private student loans. Refinancing means you get a new loan to pay off your existing student loans. The new loan usually comes with a different interest rate and repayment terms.

People often refinance to get a lower interest rate, which can save them money over time. However, it’s important to note that refinancing may not be the best option for everyone, and you should carefully consider the terms and conditions of the new loan before deciding to refinance.

Let’s know how to get the best student loan refinance rate.

How to Refinance Student Loans in 5 Easy Steps

- Understand Your Current Loans: Know what loans you have, their interest rates, and the terms. This helps you see if refinancing is a good idea.

- Check Your Credit Score: A good credit score helps you get a better refinancing deal. Make sure your credit score is in good shape before applying.

- Shop Around for Lenders: Look at different lenders and their refinancing options. Compare interest rates, terms, and fees to find the best deal for you.

- Gather Necessary Documents: Get all the documents you need for the refinancing application. This may include proof of income, loan statements, and identification.

- Apply and Review Offers: Apply for refinancing with the chosen lender. Once you get offers, review them carefully. Look at the new interest rate, monthly payments, and any fees. Choose the offer that suits you best.

Private Student Loan Refinance Rates

| Company | Website | Interest Rates (APR) | Loan Terms |

|---|---|---|---|

| SoFi | SoFi | 2.99% – 6.94% | 5 – 20 years |

| Earnest | Earnest | 2.98% – 5.79% | 5 – 20 years |

| CommonBond | CommonBond | 2.49% – 6.84% | 5 – 20 years |

| Laurel Road | Laurel Road | 2.50% – 6.65% | 5 – 20 years |

| Citizens Bank | Citizens Bank | 1.98% – 9.02% | 5 – 20 years |

| LendKey | LendKey | 1.9% – 5.25% | 5 – 20 years |

Frequently asked questions

What credit score do you need to refinance student loans?

To refinance student loans, it’s generally beneficial to have a good to excellent credit score. Lenders typically look for a credit score in the range of 650 to 700 or higher for student loan refinancing. However, the exact credit score requirements can vary among lenders.

A higher credit score often helps you qualify for a lower interest rate when refinancing, which can save you money over the life of the loan. If your credit score is below the preferred range, you may still be eligible for refinancing, but you might not get the most favorable terms.

In addition to credit score, lenders also consider factors like your income, employment history, and debt-to-income ratio when evaluating your application for student loan refinancing. It’s a good idea to check your credit score, improve it if needed, and shop around with different lenders to find the best refinancing options that match your financial situation.

When should you refinance your student loans?

Deciding when to refinance your student loans depends on your own situation. If you have private student loans with high-interest rates and a good credit score that allows you to get a lower rate through refinancing, it’s a good idea to look into it. Refinancing could help you save a lot of money on interest during your repayment period. You can use the refinancing calculator above to estimate how much you might save.

However, if you have federal student loans, it might not be the best choice to refinance unless you’ve carefully thought about the potential disadvantages. Check the next question for more information.

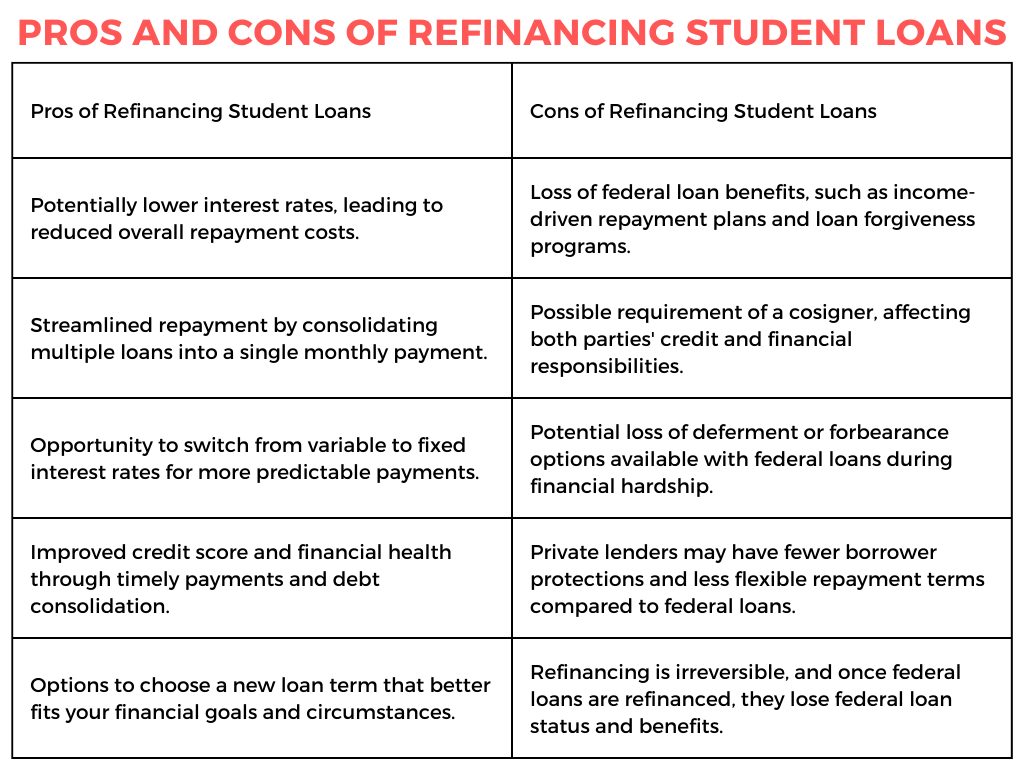

What are the downsides of refinancing student loans?

Refinancing can be not so good, especially if your family’s money situation isn’t very safe. For instance, if you decide to refinance your government loans, it might help you save money or reduce stress, but you’ll lose the special protections that only government loans give you, like we talked about earlier.

Before you put your signature on the paper, carefully consider if changing your student loans is the right thing for you, because once you make that decision, you can’t go back.