The terms ‘PTEC‘ and ‘PTRC‘ stand for Professional Tax Enrolment Certificate and Professional Tax Registration Certificate, respectively. In Maharashtra and many other states, these registrations are usually required to operate the business. PTEC permits a business entity to pay professional taxes as well as the professional or owner of the business. In other words, PTEC allows businesses to pay professional taxes for themselves and their directors. Individuals, such as professionals and single owners, must also register with PTEC.

The PTRC, from the other side, permits an employer to deduct and pay professional taxes out of an employee’s income and transfer it with the government. A typical corporation must pay its own professional tax, and also the professional tax for all its employees, as appropriate, for both PTEC and PTRC. However, if the Company or LLP does not have any payees, it will just need to pay PTEC and not PTRC, as well as pay for Directors and Partners. PTEC and PTRC registration information in Maharashtra can be found here.

This is not the end. More valuable information is provided for you to read carefully.

What is the difference between PTEC And PTRC?

The difference between PTEC and PTRC are as follows:

| PTEC | PTRC |

| PTEC stands for Professional Tax Enrollment Certificate | PTRC is Professional Tax Registration Certificate. |

| A certificate is obtained by an employer to deduct and deposit professional tax from employees’ salaries. The Full Form of PTEC is Professional Tax Enrollment Certificate | A certificate is obtained by an employer to pay their own professional tax, as well as by professional practitioners such as CAs, Doctors, etc. to pay their own professional tax. The Full Form of PTRC is Professional Tax Registration Certificate |

If we talk about when should we pay the PTEC, In the first year, a person who enrolls in PTEC must pay the tax within one month of registration. After that, you can make your payment on June 30th of each year.

PTEC and PTRC

- Every company, individual, or professional must take PTEC. There is a distinct classification. Once the company has received the PTEC, they must file their PTEC Return on a yearly basis. PTEC Certificates can be obtained by any firm, individual, or professional who pays the PTEC fee of RS 2500.

- Every GST-registered dealer, whether selling taxable or exempt items, must also register with PTEC and file a PT Return.

- Every taxpayer must get a certificate of registration, such as a Professional Tax Registration Certificate (PTRC) or a Professional Tax Enrollment Certificate, in order to pay Maharashtra Professional Tax (PTEC).

- In the case of salaried employees, it is the employer’s responsibility to deduct the appropriate amount of tax from the employee’s salary each month and remit it to the state government.

- People who have reached the age of 65. will eligible for the PTEC.

- In the first year, every enrolled person must pay the tax within one month of the date of enrolment, and thereafter by June 30th of each year.

- When a person works in a profession for two or more employers and earns more than Rs. 5000 in pay or wages, but the employer does not deduct professional tax, the individual must obtain an enrolment certificate from the authority.

- Profession Tax (PT) is a tax charged by the respective state governments in India on employment and profession. The Karnataka Tax on Professions, Trades, Callings, and Employments Act, 1976 imposes a profession tax in the state of Karnataka.

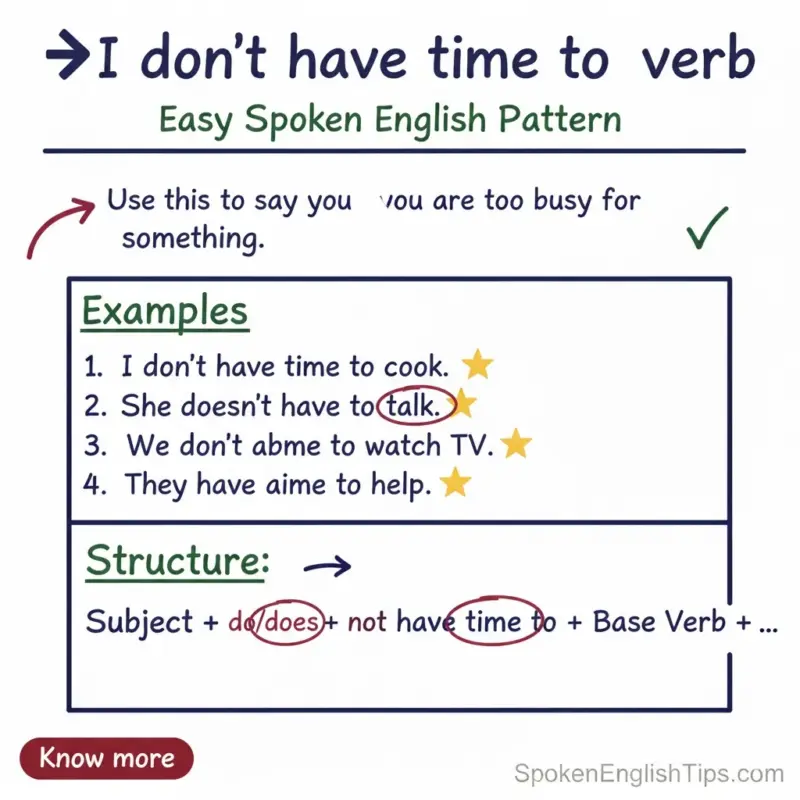

12 More Spoken English book pdf free download

What will you get?

- English-speaking lessons tips

- English conversation topics above 100 lessons are there you can practice it.

- 1000+ vocabularies

- Daily use of words for English speaking

- English phrases

- Idioms for English speaking

- Basics of English Grammar Free eBook for beginners

- Personality development course

- Vocabularies used in Body language

- Common words for English speaking

- Pdf eBooks for Improvement of English

- Download Free English-speaking pdf ebooks of Spoken English Tips

Many English-speaking Lessons will be provided which will be absolutely free. We are working to provide you with more and more valuable information to enhance your English speaking.

- 10 Lines

- Abbreviations

- AI & Machine Learning

- AI Arts

- AI Tools

- Alabama

- Apology letters

- Apology massages

- Application Letters

- Basic To Advance English

- Basics of Structures

- Best books to read

- Biography

- Blog

- Business Writing

- Children Stories

- Christmas

- College

- conversion

- Courses

- Daily use English sentences

- Definition

- Degree

- Download

- Educational News

- English conversation practice

- English Speaking Basics

- Essay writing

- Examples & Sentences

- Festivals

- Full forms

- Generator Tools

- German

- Grammar

- Health Education

- How to

- How to pronounce

- Human

- I love you

- Indonesia

- Kindergarten

- Letter Writing

- Make money

- Mathematics

- Messages

- Multiplication table

- Noun

- Personality Tips

- Phrases

- Podcast

- Prompts

- Quiz

- Quotes

- Recommendation letter

- Russia

- Shapes

- Short Stories

- Signs Tips

- soft skills

- Spanish

- spoken english classes

- Spoken english pdf

- Spoken Tips

- Stories

- study abroad

- Tools

- Trending

- Trivia Questions

- United States

- Verbs

- Vocabulary

- Ways to Say

- web stories

- Wishes

- words

- worksheets

- Write

- Writing